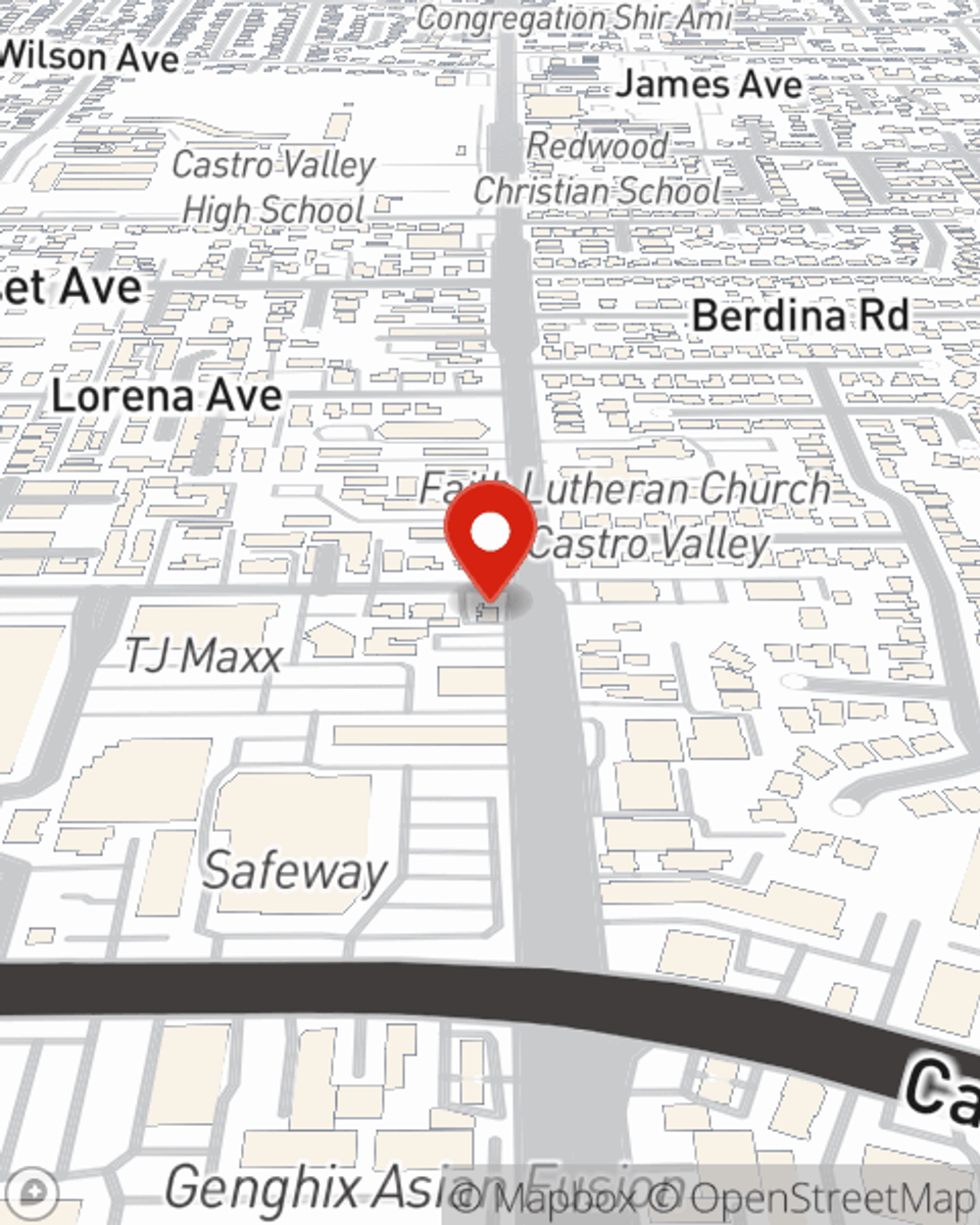

Business Insurance in and around Castro Valley

Castro Valley! Look no further for small business insurance.

Cover all the bases for your small business

- Castro Valley

- Hayward

- San Leandro

- San Lorenzo

- Ashland

- Cherryland

- Oakland

- Alameda County

- East Bay Area

This Coverage Is Worth It.

Operating your small business takes dedication, effort, and outstanding insurance. That's why State Farm offers coverage options like errors and omissions liability, extra liability coverage, a surety or fidelity bond, and more!

Castro Valley! Look no further for small business insurance.

Cover all the bases for your small business

Protect Your Business With State Farm

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance policies by small business owners like you. You can work with State Farm agent Todd Anglin for a policy that safeguards your business. Your coverage can include everything from a surety or fidelity bond or business continuity plans to key employee insurance or group life insurance if there are 5 or more employees.

Get right down to business by contacting agent Todd Anglin's team to talk through your options.

Simple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Todd Anglin

State Farm® Insurance AgentSimple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.